The Most Profitable Bitcoin Miner: A Guide to Maximizing Your Mining Earnings

With Bitcoin’s ongoing popularity and increasing value, mining has become a highly competitive industry, with many seeking the most efficient and profitable mining hardware. The profitability of a Bitcoin miner depends on several factors, including energy consumption, hash rate, and efficiency. At OEMG Miner, we’re dedicated to helping miners maximize their profits by providing top-tier mining hardware that combines high performance with low energy consumption.

In this guide, we’ll dive into the features of the most profitable Bitcoin miners available today and explain what factors contribute to mining profitability. Let’s explore how you can choose the best equipment to maximize your earnings and stay competitive in this dynamic market.

Key Factors That Determine Mining Profitability

To understand what makes a Bitcoin miner profitable, it’s essential to look at a few key factors:

Hash Rate

The hash rate measures a miner’s computational power, or how many calculations it can perform per second. A higher hash rate means the miner can solve complex calculations faster, increasing the chances of mining new blocks and earning rewards. Generally, a high hash rate is essential for maximizing profitability, but it should be balanced with energy consumption.

Power Efficiency

Power efficiency is crucial because mining requires substantial energy. The more energy-efficient a miner is, the lower the electricity costs, resulting in a higher profit margin. Ideally, the best Bitcoin miners have a high hash rate with low power consumption.

Cost of Equipment

While some miners offer exceptional performance, they can be expensive. Finding a balance between upfront cost and profitability is essential. Often, a more costly but efficient miner can provide better returns over time due to its high efficiency and longevity.

Electricity Cost

Electricity cost is a significant factor, as it can substantially affect mining profitability. High power efficiency in your hardware can reduce electricity costs, which is especially important for miners in regions with high energy prices.

Difficulty and Market Conditions

Mining profitability also depends on network difficulty and Bitcoin’s market price. Difficulty adjustments affect how challenging it is to mine Bitcoin, while Bitcoin’s market value influences the dollar value of mining rewards.

The Most Profitable Bitcoin Miners of 2024

Let’s take a closer look at some of the top Bitcoin miners that are proving to be profitable choices for miners in 2024.

1. Antminer S19K Pro-115T

The Antminer S19K Pro-115T is one of Bitmain’s top-performing models, known for its powerful hash rate and excellent energy efficiency, making it a strong contender for profitable mining.

Specifications:

Hash Rate: 115 TH/s

Power Consumption: 2645W

Efficiency: 23 J/TH

With a hash rate of 115 terahashes per second and a power consumption of 2645 watts, the S19K Pro-115T achieves an energy efficiency of 23 joules per terahash. This balance of performance and efficiency makes it a compelling choice for miners aiming to maximize profitability while managing operational costs.

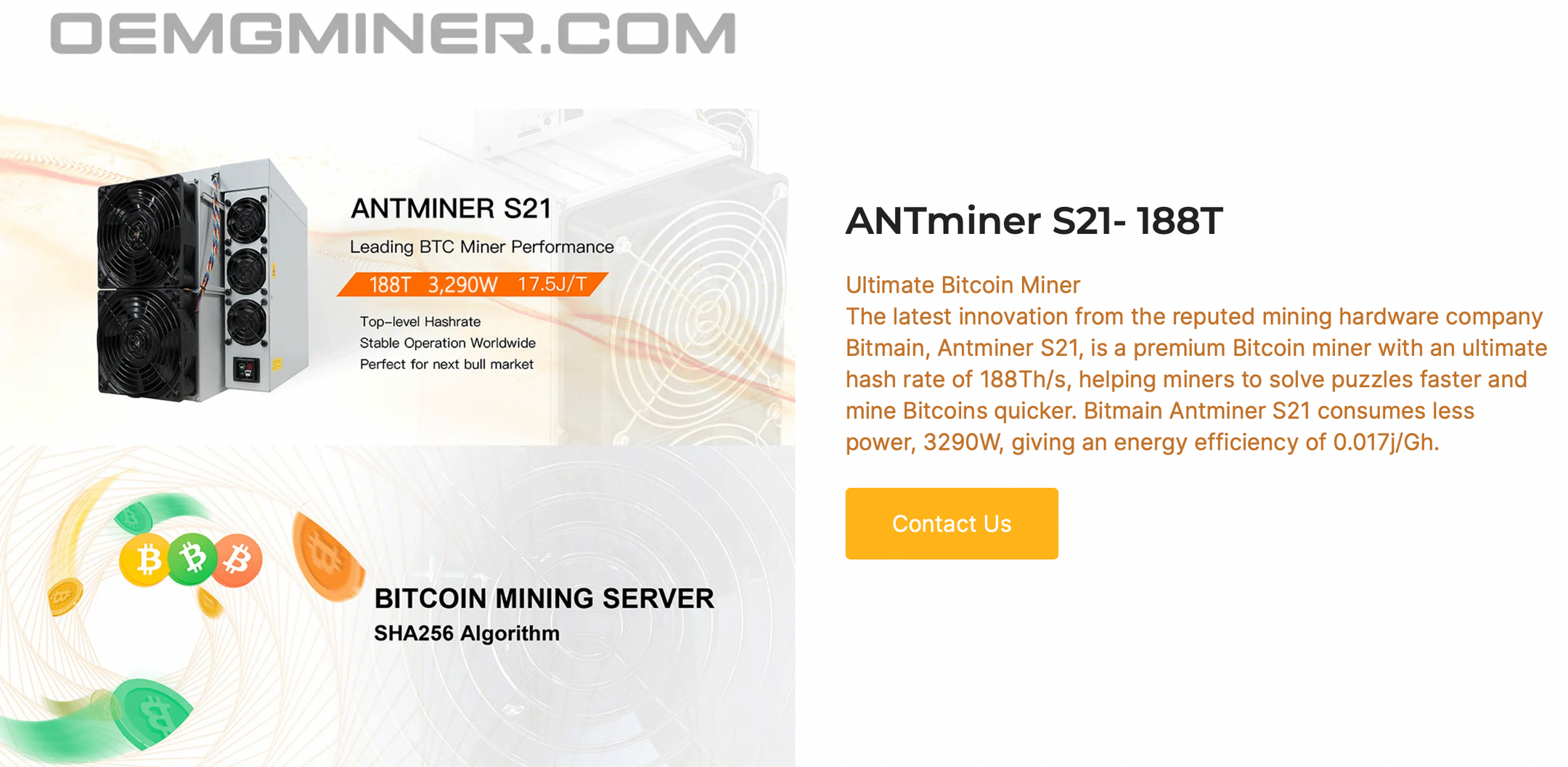

2. Antminer S21 188T

The Antminer S21 188T is a top-tier mining solution, designed for those seeking high performance and energy efficiency in Bitcoin mining.

Specifications:

Hash Rate: 188 TH/s (±10%)

Power Consumption: 3290W

Efficiency: 17.5 J/TH

With its impressive hash rate of 188 TH/s and an energy efficiency of 17.5 J/TH, the Antminer S21 188T is an excellent choice for miners focused on maximizing profits. This model’s efficiency is particularly beneficial in regions where electricity costs are moderate to high, allowing miners to maintain profitability while controlling operational expenses. Its robust design also ensures long-lasting performance.

3. Antminer S21 200T

The Antminer S21 200T is Bitmain’s latest high-performance Bitcoin miner, offering exceptional power and efficiency, ideal for large-scale mining operations aiming for maximum profitability.

Specifications:

Hash Rate: 200 TH/s (±10%)

Power Consumption: 3500W

Efficiency: 17.5 J/TH

With an impressive hash rate of 200 TH/s and a power efficiency of 17.5 J/TH, the Antminer S21 200T delivers top-tier performance while managing energy costs effectively. This makes it a perfect choice for miners operating in regions with moderate electricity costs, looking to achieve optimal returns on their investment. The durable design and efficient cooling system further enhance its reliability and longevity, making it a solid addition to any mining setup.

Choosing the Right Miner for Your Needs

Selecting the right Bitcoin miner depends on factors such as budget, electricity costs, and your mining goals. Here’s a guide to help you find the best fit:

1. Upfront Cost vs. Long-Term Profitability

High-performance miners like the Antminer S21 200T or Antminer S21 188T offer impressive efficiency and power, but they come with a higher upfront cost. For miners who can afford the investment, the superior long-term profitability often justifies the initial expense, as these miners can yield higher returns over time. However, if you’re working within a limited budget, models like the Antminer S19K Pro-115T, which provides a strong balance between cost and efficiency, may be a more suitable option.

2. Electricity Rates

Electricity costs play a crucial role in mining profitability. If you are in a region with high electricity rates, selecting a miner with outstanding power efficiency, such as the Antminer S21 188T or S21 200T, can help reduce operational expenses and maintain profitability. These models have energy efficiencies as low as 17.5 J/TH, making them ideal for regions with elevated electricity costs. Conversely, miners in areas with lower electricity costs may prioritize hash rate over efficiency, choosing models with the highest hash rates, like the S21 200T.

3. Scaling Up

For larger mining operations, a strategic mix of miners can optimize costs and profitability. High-efficiency models like the Antminer S19K Pro-115T can be combined with top-performing miners like the S21 188T or S21 200T to create a balanced setup that maximizes hash rate while controlling energy consumption. At OEMG Miner, we offer a wide range of mining hardware, allowing you to scale up your operation with the ideal combination of performance, efficiency, and cost-effectiveness.

Tips to Maximize Mining Profitability

In addition to choosing the right mining hardware, several strategies can help you maximize your mining profitability:

Optimize Your Setup

Ensure your mining rigs are properly ventilated to avoid overheating, which can reduce efficiency and the lifespan of your equipment. Investing in cooling systems can help maintain optimal performance and prevent downtime.

Join a Mining Pool

Mining pools allow miners to combine their computing power, improving the chances of earning consistent rewards. Pool mining is an excellent option for small-scale miners who may struggle to earn consistent rewards on their own.

Stay Updated on Market Conditions

Bitcoin’s market price and network difficulty fluctuate frequently. Staying informed about these changes can help you make timely adjustments, such as increasing or reducing mining capacity to maintain profitability.

Regular Maintenance

Routine maintenance, including cleaning and checking connections, can prevent malfunctions and prolong the life of your mining equipment. Keeping your hardware in good condition ensures stable performance and minimizes downtime.

Upgrade When Necessary

The mining industry evolves quickly, and new, more efficient models are released regularly. Keeping an eye on market trends and upgrading when necessary can help you stay competitive and maximize profits over time.

OEMG Miner: Your Partner for Profitable Mining

At OEMG Miner, we are dedicated to providing high-quality, efficient, and reliable mining hardware for all types of mining operations. We understand the complexities of mining and the importance of profitability, which is why we offer a range of products designed to meet the needs of miners at every level.

Our team is here to help you find the best equipment for your goals and budget, ensuring you have the tools needed to succeed in the competitive mining industry. With our expertise and commitment to quality, OEMG Miner is your trusted partner for profitable Bitcoin mining.